Capital Decisions, Powered by Real-Time Intelligence

Online service delivering total financial control for CFOs of production corporations

BOOK A DEMO

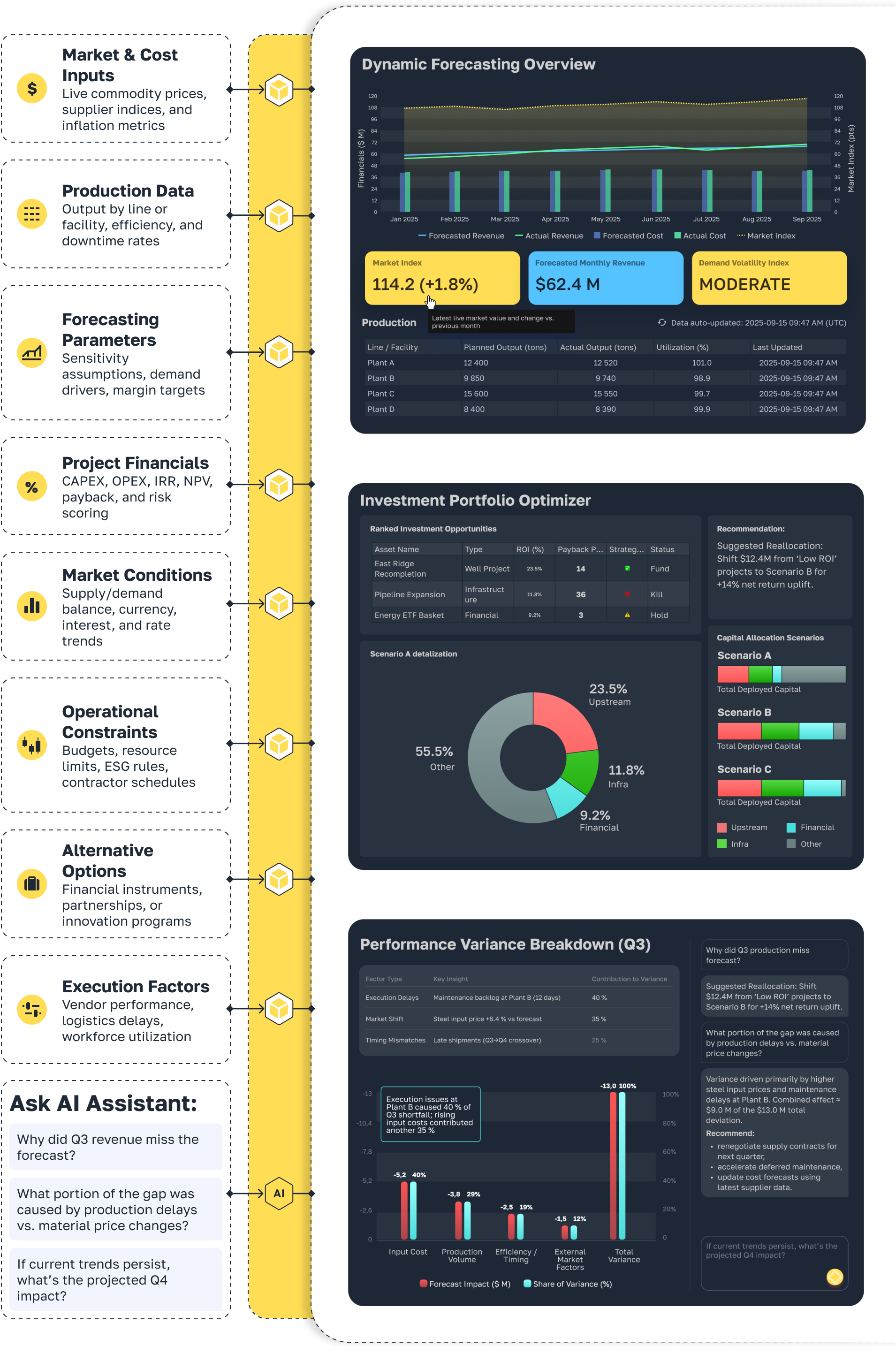

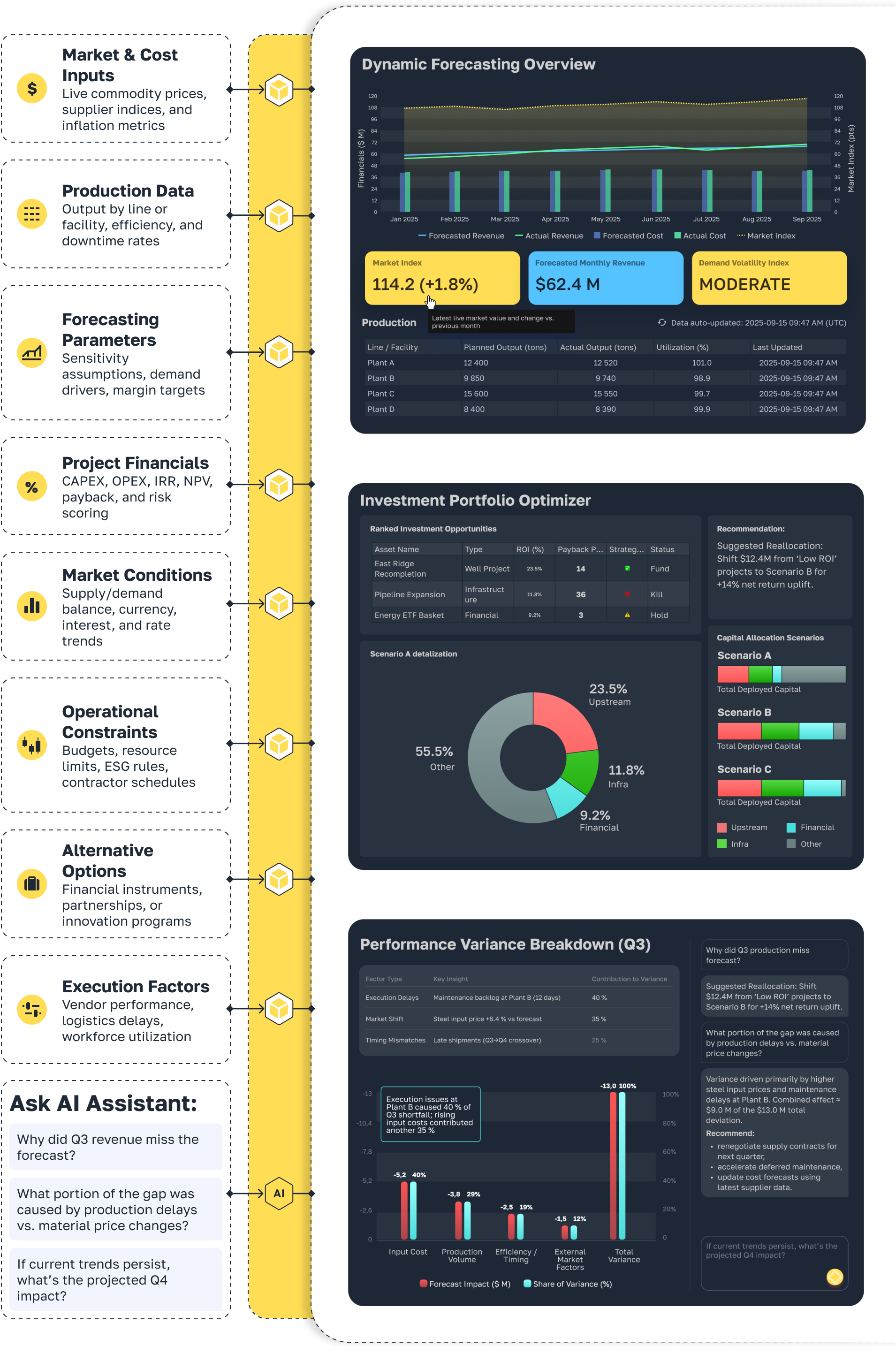

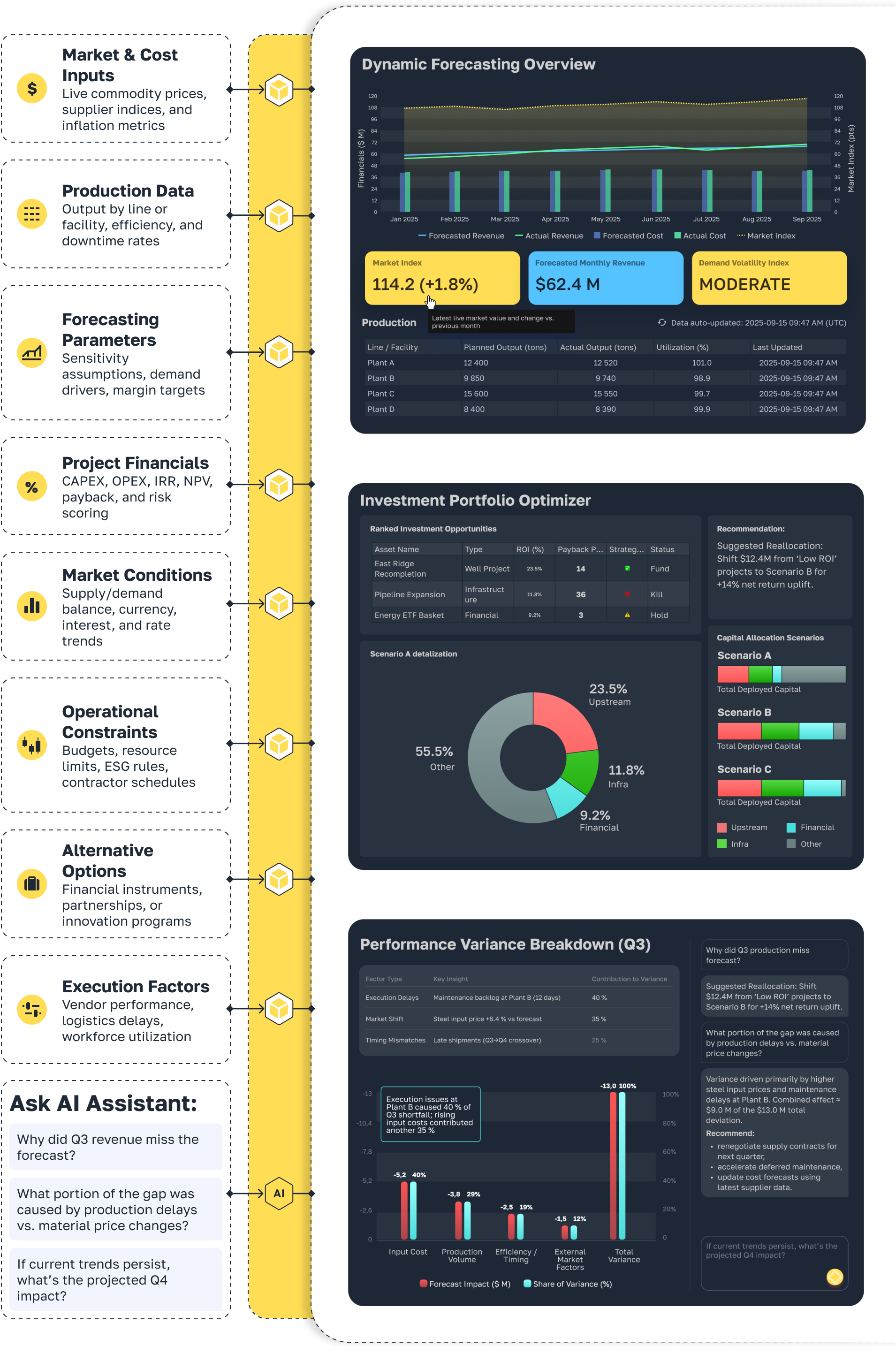

Dynamic Forecast Dashboard

From Volatility to Control: Turn market and operational uncertainty into real-time financial clarity. No more static spreadsheets — decisions adapt as fast as your environment does

What’s Holding CFOs

Back

Forecasts break down when input costs, demand, or production rates fluctuate

Rising raw material or logistics costs disrupt budgets mid-cycle

Endless forecast revisions drain time and focus from strategic work

Long planning cycles make it hard to pivot when global conditions change

What 3V.FINNAVIGATOR

Unlocks

Live operational and market data automatically flow into revenue and cost models

Forecasts and budgets refresh dynamically as material prices or output levels shift

Simulates multiple scenarios instantly to stress-test cash flow and margins

Finance, operations, and production teams collaborate using one live dataset

What CFO Gains

Planning resilience in volatile markets

Far fewer manual revisions and data errors

Consistent, trustworthy forecasts — always based on the latest data

Faster course corrections when trends change

Forecast Update Speed:

Up to 4-6x faster forecast updates

Forecast Accuracy Improvement:

+25–45% higher accuracy during volatile demand or pricing periods

Time Saved per Forecast Revision:

Avg. 10–18 hours saved per re-forecast cycle

Enterprise Capital Optimizer

Allocate with Precision: Optimize capital deployment and balance growth with financial discipline — continuously.

What’s Holding CFOs

Back

Competing capital requests exceed available budgets

Limited visibility into true ROI and payback speed of initiatives

Cash locked up in slow-turning projects or excess inventory

Balancing short-term liquidity and long-term value is often guesswork

What 3V.FINNAVIGATOR

Unlocks

Detects idle or underperforming capital and redeploys it toward high-return options

Scores every project or initiative by ROI, payback, and risk-adjusted return

Models the financial impact of higher rates, cost inflation, or supply chain delays

Flags when too much capital is tied up for too long — before it constrains growth

Helps finance leaders evaluate debt-free and strategic funding alternatives

What CFO Gains

Continuous visibility into enterprise-wide capital productivity

Confidence in explaining capital trade-offs to boards and investors

Greater agility when market opportunities arise

Less reliance on static CAPEX plans and late-stage funding adjustments

Capital Efficiency Gain:

10–20% more capital unlocked by avoiding low-ROI or delayed projects

CAPEX Reallocation Rate:

+20–35% more investment directed toward high-impact initiatives

Investment Evaluation Speed:

3–5x faster portfolio scoring and decision workflows

Performance Analyzer

From Defense to Insight: Deliver transparent, evidence-based explanations for every variance. Reframe variances as managed risks.

What’s

Holding CFOs

Back

CFOs are held accountable for shifts outside their control — material costs, currency, demand

Forecast misses erode confidence even when caused by external events

Explaining complex deviations requires manual data digging and days of preparation

What

FINNAVIGATOR

Unlocks

Converts complex data into a clear, executive-friendly online monitor

Automatically explains deltas between actual vs. forecasted figures (cost, volume, timing)

Distinguishes external factors (market, supply, inflation) from internal execution drivers

Built-in AI assistant answers natural-language questions such as: “Why did Q3 revenue miss the forecast?”...

AI-generated responses are traceable and supported by data citations

What CFO Gains

Clear separation of controllable vs. uncontrollable impacts

Faster, defensible reporting — from plant floor to boardroom

A proactive narrative when volatility hits — not reactive explanations

Time reclaimed from reporting to decision-making

Time-to-Explain Forecast Deviations:

Up to 90% faster (from days to minutes)

Unexplained Variance Rate:

Reduced by 60–80% through automatic factor analysis

Board-Ready Report Generation Time:

Cut from 8–10 hours to under 1 hour

Solution

Unlike traditional ERP or BI tools, FINNAVIGATOR:

Makes financial decisions instant, not delayed

Enables moment-of-change forecasting instead of quarterly catch-up

Supports planning resilience under stress

Drives capital efficiency across all assets and projects

Builds clear, auditable variance trails for every assumption

Aligns finance, production, and operations under one version of truth

The CFO’s Unified Command Center

for Modern Production Finance

A cloud-native, AI-enhanced online financial service built for CFOs managing capital-intensive production environments — where margins, costs, and markets shift daily

Seamlessly connect ERP systems (e.g., SAP, Oracle), MES data, operational dashboards, and market feeds

Reduce manual reporting, strengthen forecast accuracy, and create board-ready deliverables with full traceability

Compare growth plans, capital risks, and shareholder outcomes — in one collaborative workspace

Finance, operations, and strategy teams plan together — using live, validated data

Export board-ready reports, charts, and scenario walkthroughs with audit trails

Auto-ingestion, audit trails, and data validation build trust in the numbers

This isn’t just a finance tool. It’s a decision engine for the modern production enterprise.

Book a Demo

Capital Decisions, Powered by Real-Time Intelligence

Online service delivering total financial control for CFOs of production corporations

Dynamic Forecast Dashboard

From Volatility to Control: Turn market and operational uncertainty into real-time financial clarity. No more static spreadsheets — decisions adapt as fast as your environment does

What’s Holding CFOs

Back

Forecasts break down when input costs, demand, or production rates fluctuate

Rising raw material or logistics costs disrupt budgets mid-cycle

Endless forecast revisions drain time and focus from strategic work

Long planning cycles make it hard to pivot when global conditions change

What

FINNAVIGATOR

Unlocks

Live operational and market data automatically flow into revenue and cost models

Forecasts and budgets refresh dynamically as material prices or output levels shift

Simulates multiple scenarios instantly to stress-test cash flow and margins

Finance, operations, and production teams collaborate using one live dataset

What CFO Gains

Planning resilience in volatile markets

Far fewer manual revisions and data errors

Consistent, trustworthy forecasts — always based on the latest data

Faster course corrections when trends change

Forecast Update Speed:

Up to 4-6x faster forecast updates

Forecast Accuracy Improvement:

+25–45% higher accuracy during volatile demand or pricing periods

Time Saved per Forecast Revision:

Avg. 10–18 hours saved per re-forecast cycle

Enterprise Capital Optimizer

Allocate with Precision: Optimize capital deployment and balance growth with financial discipline — continuously.

What’s Holding CFOs

Back

Competing capital requests exceed available budgets

Limited visibility into true ROI and payback speed of initiatives

Cash locked up in slow-turning projects or excess inventory

Balancing short-term liquidity and long-term value is often guesswork

What

FINNAVIGATOR

Unlocks

Detects idle or underperforming capital and redeploys it toward high-return options

Scores every project or initiative by ROI, payback, and risk-adjusted return

Models the financial impact of higher rates, cost inflation, or supply chain delays

Flags when too much capital is tied up for too long — before it constrains growth

Helps finance leaders evaluate debt-free and strategic funding alternatives

What CFO Gains

Continuous visibility into enterprise-wide capital productivity

Confidence in explaining capital trade-offs to boards and investors

Greater agility when market opportunities arise

Less reliance on static CAPEX plans and late-stage funding adjustments

Capital Efficiency Gain:

10–20% more capital unlocked by avoiding low-ROI or delayed projects

CAPEX Reallocation Rate:

+20–35% more investment directed toward high-impact initiatives

Investment Evaluation Speed:

3–5x faster portfolio scoring and decision workflows

Performance Analyzer

From Defense to Insight: Deliver transparent, evidence-based explanations for every variance. Reframe variances as managed risks.

What’s

Holding CFOs

Back

CFOs are held accountable for shifts outside their control — material costs, currency, demand

Forecast misses erode confidence even when caused by external events

Explaining complex deviations requires manual data digging and days of preparation

What

FINNAVIGATOR

Unlocks

Converts complex data into a clear, executive-friendly online monitor

Automatically explains deltas between actual vs. forecasted figures (cost, volume, timing)

Distinguishes external factors (market, supply, inflation) from internal execution drivers

Built-in AI assistant answers natural-language questions such as: “Why did Q3 revenue miss the forecast?”...

AI-generated responses are traceable and supported by data citations

What

CFO

Gains

Clear separation of controllable vs. uncontrollable impacts

Faster, defensible reporting — from plant floor to boardroom

A proactive narrative when volatility hits — not reactive explanations

Time reclaimed from reporting to decision-making

Time-to-Explain Forecast Deviations:

Up to 90% faster (from days to minutes)

Unexplained Variance Rate:

Reduced by 60–80% through automatic factor analysis

Board-Ready Report Generation Time:

Cut from 8–10 hours to under 1 hour

Solution

Unlike traditional ERP or BI tools, FINNAVIGATOR:

Makes financial decisions instant, not delayed

Enables moment-of-change forecasting instead of quarterly catch-up

Provides more reliable financial planning under stress

Drives capital efficiency across all assets and projects

Builds clear, auditable variance trails for every assumption

Aligns finance, production, and operations under one version of truth

The CFO’s Unified Command Center

for Modern Production Finance

A cloud-native, AI-enhanced online financial service built for CFOs managing capital-intensive production environments — where margins, costs, and markets shift daily

Seamlessly connect ERP systems (e.g., SAP, Oracle), MES data, operational dashboards, and market feeds

Reduce manual reporting, strengthen forecast accuracy, and create board-ready deliverables with full traceability

Compare growth plans, capital risks, and shareholder outcomes — in one collaborative workspace

Finance, operations, and strategy teams plan together — using live, validated data

Export board-ready reports, charts, and scenario walkthroughs with audit trails

Auto-ingestion, audit trails, and data validation build trust in the numbers

This isn’t just a finance tool. It’s a decision engine for the modern production enterprise.

Book a Demo

Capital Decisions, Powered by Real-Time Intelligence

Online service delivering total financial control for CFOs of production corporations

Dynamic Forecast Dashboard

From Volatility to Control: Turn market and operational uncertainty into real-time financial clarity. No more static spreadsheets — decisions adapt as fast as your environment does

What’s Holding CFOs

Back

Forecasts break down when input costs, demand, or production rates fluctuate

Rising raw material or logistics costs disrupt budgets mid-cycle

Endless forecast revisions drain time and focus from strategic work

Long planning cycles make it hard to pivot when global conditions change

What

FINNAVIGATOR

Unlocks

Live operational and market data automatically flow into revenue and cost models

Forecasts and budgets refresh dynamically as material prices or output levels shift

Simulates multiple scenarios instantly to stress-test cash flow and margins

Finance, operations, and production teams collaborate using one live dataset

What CFO Gains

Planning resilience in volatile markets

Far fewer manual revisions and data errors

Consistent, trustworthy forecasts — always based on the latest data

Faster course corrections when trends change

Forecast Update Speed:

Up to 4-6x faster forecast updates

Forecast Accuracy Improvement:

+25–45% higher accuracy during volatile demand or pricing periods

Time Saved per Forecast Revision:

Avg. 10–18 hours saved per re-forecast cycle

Enterprise Capital Optimizer

Allocate with Precision: Optimize capital deployment and balance growth with financial discipline — continuously.

What’s Holding CFOs

Back

Competing capital requests exceed available budgets

Limited visibility into true ROI and payback speed of initiatives

Cash locked up in slow-turning projects or excess inventory

Balancing short-term liquidity and long-term value is often guesswork

What

FINNAVIGATOR

Unlocks

Detects idle or underperforming capital and redeploys it toward high-return options

Scores every project or initiative by ROI, payback, and risk-adjusted return

Models the financial impact of higher rates, cost inflation, or supply chain delays

Flags when too much capital is tied up for too long — before it constrains growth

Helps finance leaders evaluate debt-free and strategic funding alternatives

What CFO Gains

Continuous visibility into enterprise-wide capital productivity

Confidence in explaining capital trade-offs to boards and investors

Greater agility when market opportunities arise

Less reliance on static CAPEX plans and late-stage funding adjustments

Capital Efficiency Gain:

10–20% more capital unlocked by avoiding low-ROI or delayed projects

CAPEX Reallocation Rate:

+20–35% more investment directed toward high-impact initiatives

Investment Evaluation Speed:

3–5x faster portfolio scoring and decision workflows

Performance Analyzer

From Defense to Insight: Deliver transparent, evidence-based explanations for every variance. Reframe variances as managed risks.

What’s

Holding CFOs

Back

CFOs are held accountable for shifts outside their control — material costs, currency, demand

Forecast misses erode confidence even when caused by external events

Explaining complex deviations requires manual data digging and days of preparation

What

FINNAVIGATOR

Unlocks

Converts complex data into a clear, executive-friendly online monitor

Automatically explains deltas between actual vs. forecasted figures (cost, volume, timing)

Distinguishes external factors (market, supply, inflation) from internal execution drivers

Built-in AI assistant answers natural-language questions such as: “Why did Q3 revenue miss the forecast?”...

AI-generated responses are traceable and supported by data citations

What

CFO

Gains

Clear separation of controllable vs. uncontrollable impacts

Faster, defensible reporting — from plant floor to boardroom

A proactive narrative when volatility hits — not reactive explanations

Time reclaimed from reporting to decision-making

Time-to-Explain Forecast Deviations:

Up to 90% faster (from days to minutes)

Unexplained Variance Rate:

Reduced by 60–80% through automatic factor analysis

Board-Ready Report Generation Time:

Cut from 8–10 hours to under 1 hour

Solution

Unlike traditional ERP or BI tools, FINNAVIGATOR:

Makes financial decisions instant, not delayed

Enables moment-of-change forecasting instead of quarterly catch-up

Supports planning resilience under stress

Drives capital efficiency across all assets and projects

Builds clear, auditable variance trails for every assumption

Aligns finance, production, and operations under one version of truth

The CFO’s Unified Command Center

for Modern Production Finance

A cloud-native, AI-enhanced online financial service built for CFOs managing capital-intensive production environments — where margins, costs, and markets shift daily

Seamlessly connect ERP systems (e.g., SAP, Oracle), MES data, operational dashboards, and market feeds

Reduce manual reporting, strengthen forecast accuracy, and create board-ready deliverables with full traceability

Compare growth plans, capital risks, and shareholder outcomes — in one collaborative workspace

Finance, operations, and strategy teams plan together — using live, validated data

Export board-ready reports, charts, and scenario walkthroughs with audit trails

Auto-ingestion, audit trails, and data validation build trust in the numbers

This isn’t just a finance tool. It’s a decision engine for the modern production enterprise.

Book a Demo